Nifty Top 10 Equal Weight Vs Nifty 50 – Which is better?

Top 10 stocks in the Nifty 50 make up about 56% of the index. Then, is it wise to consider Nifty Top 10 Equal Weight as an alternative to Nifty 50 Index?

Recently, my client posed a question regarding the newly launched Nifty Top 10 Equal Weight Index Fund by DSP AMC. Therefore, it is essential to explore this inquiry further to uncover the answer.

What is the Nifty Top 10 Equal Weight Index?

The Nifty Top 10 Equal Weight Index is designed to monitor the performance of the ten leading stocks chosen based on their six-month average free-float market capitalization from the Nifty 50. Established on March 2, 2006, the index has a base value set at 1000. Stocks that are part of the Nifty 50 index during the review period qualify for inclusion in this index. Each stock within the index is assigned an equal weight. The index undergoes reconstitution twice a year and is rebalanced every three months.

The current holdings of the Nifty Top 10 Equal Weight Index are as below (along with what % of these stocks are in the Nifty 50 Index).

| Top 10 Holdings of Nifty Top 10 Equal Weight Index Stocks with % of holding | Nifty 50 holding % | |

| Infosys Ltd | 11.40% | 6.12% |

| ITC Ltd | 11.01% | 4.15% |

| Tata Consultancy Services Ltd | 10.75% | 4.03% |

| Hindustan Unilever Ltd | 10.47% | 2.28% |

| Larsen and Toubro Ltd | 10.01% | 4.04% |

| Reliance Industries Ltd | 9.74% | 9.23% |

| Kotak Mahindra Bank Ltd | 9.55% | 2.32% |

| ICICI Bank Ltd | 9.54% | 7.75% |

| HDFC Bank Ltd | 8.89% | 11.03% |

| Axis Bank Ltd | 8.63% | 3.01% |

Now let us try to understand and find the answer regarding Nifty Top 10 Equal Weight Vs Nifty 50 – Which is better? As the Nifty Top 10 Equal Weight Index launched in 2nd March 2006, let us consider Nifty 50 data also from that day itself. Hence, we have around 4,581 daily data points. Do remember that I have considered the Toral Return Index in both cases.

Let us first consider the lump sum movement of both indices from 2nd March 2006 to now if someone invested Rs.1,00,000.

You noticed that Nifty Top 10 Equal Weight Index performance looks fantastic, however, rather than relying on this data. Let us check out the drawdown of both the indices.

A drawdown can be defined as the extent to which an investment’s value has decreased from its maximum level (peak) to its minimum level (trough) prior to any recovery. This metric is typically represented as a percentage. For instance, if an investment reached a value of Rs.10,000 at its peak and subsequently declined to Rs.8,000, the drawdown would amount to 20%. This information is crucial for investors as it provides insight into the risks and possible losses they may encounter during times of unfavorable returns.

You noticed that the majority of the time Nifty Top 10 Equal Weight drawdown is bit high than the Nifty 50.

Let us now move on to understand the rolling returns of various periods.

# 1 Year Rolling Returns and Rolling Risk of Nifty Top 10 Equal Weight Vs Nifty 50

For around 59% of times, Nifty Top 10 Equal Weight Index outperformed the Nifty 50 Index for 1 year rolling returns period. However, let us try to understand the volatility of returns by looking into 1 year rolling volatility or rolling standard deviation.

The calculation of standard deviation is based on daily returns, which are subsequently annualized by multiplying it by the square root of the number of trading days in a year, typically ranging from 250 to 252. The frequency can be based on specified intervals (like 1 year, 3 years, 5 years, or 10 years).

You noticed that throughout the journey the volatility is more for Nifty Top 10 Equal Weight Index than Nifty 50.

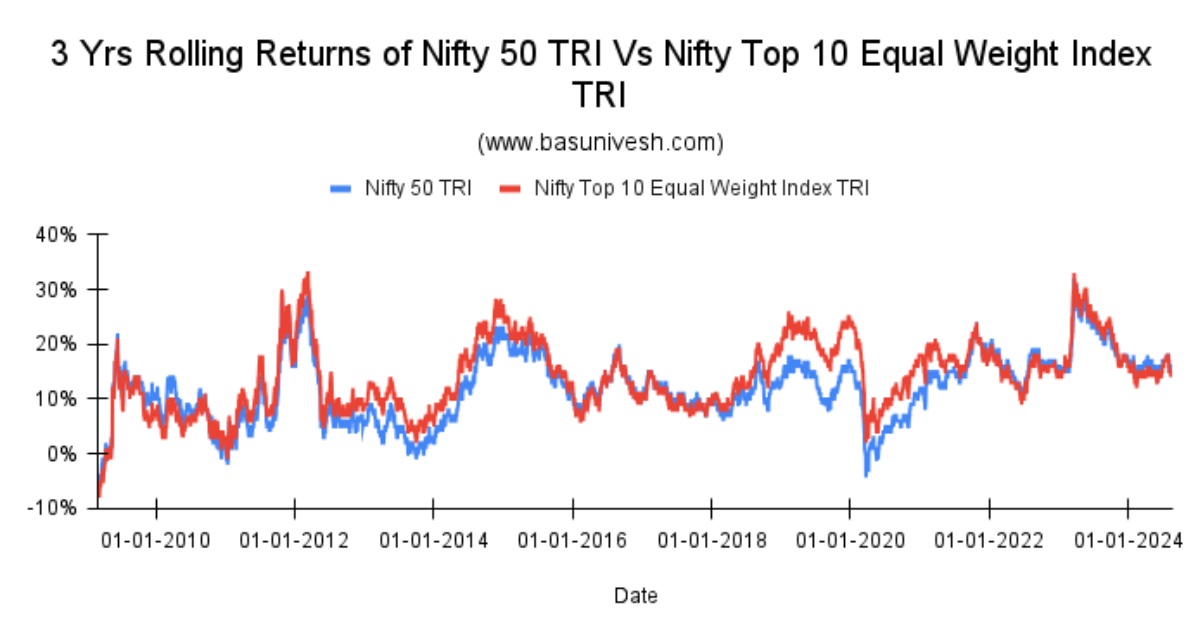

# 3 Years Rolling Returns and Rolling Risk of Nifty Top 10 Equal Weight Vs Nifty 50

In the case of 3 3-year rolling period, the outperformance of the Nifty Top 10 Equal Weight Index is more than 1 year of rolling returns. It is around 62%. However, if you look into the below chart of 3 years of rolling risk, you will notice that the Nifty Top 10 Equal Weight Index is posing more volatility than the Nifty 50.

# 5 Years Rolling Returns and Rolling Risk of Nifty Top 10 Equal Weight Vs Nifty 50

Let us now look into 5-year rolling returns and rolling returns. The results are almost similar like 3 years.

It’s an eye-catching performance of Nifty Top 10 Equal Weight Vs Nifty 50. Around 84% of the time it outperformed the Nifty 50 Index, however, with higher volatility (visible in the below image of 5 years of rolling volatility).

# 10 Years Rolling Returns and Rolling Risk of Nifty Top 10 Equal Weight Vs Nifty 50

Fantastic outperformance of Nifty Top 10 Equal Weight Vs Nifty 50 for a 10-year rolling period (for almost more than 90% of the time). However, again it has higher volatility than the Nifty 50 (see below chart of rolling risk).

Conclusion – Even though the outperformance of Nifty’s Top 10 Equal Weight is clearly visible, due to its concentrated risk, it poses a huge risk also. Hence, rather than owning the top 10 equal weight, better to own a simple Nifty 50 Index. Equal weight of Nifty Top 10 Equal Weight Vs Nifty 50 will hardly be effective in reducing the risk.

For Unbiased Advice Subscribe To Our Fixed Fee Only Financial Planning Service

Subscribe to our latest blog posts