Weekend Stock Market Outlook – August 11 2024

Stock Market Outlook entering the Week of August 11th = Downtrend

- ADX Directional Indicators: Downtrend

- On Balance Volume Indicator: Downtrend

- Institutional Activity (Price & Volume): Mixed

ANALYSIS

The stock market outlook enters the second week of a downtrend after an extremely volatile week for global equity traders.

Despite all the price movement, the S&P500 ($SPX) was flat for the week. The index sits ~2% below the 50-day moving average and ~6% above the 200-day moving average.

The ADX and institutional activity remain bearish. On Balance Volume shifts to mixed as it oscillates around its moving average.

Sector-wise, Industrials were the best performer last week ($XLI), while Materials ($XLB) led to the downside (an odd pairing for best/worst sectors).

From a sector style perspective, Momentum was the best, while Small Cap Value was the worst. Both were at extremes (oversold/overbought, respectively), so the reversions aren’t too surprising.

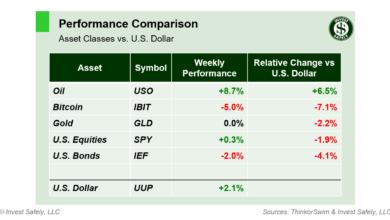

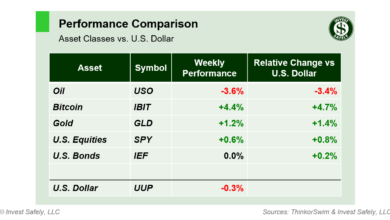

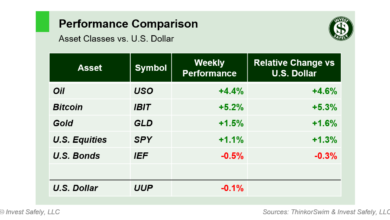

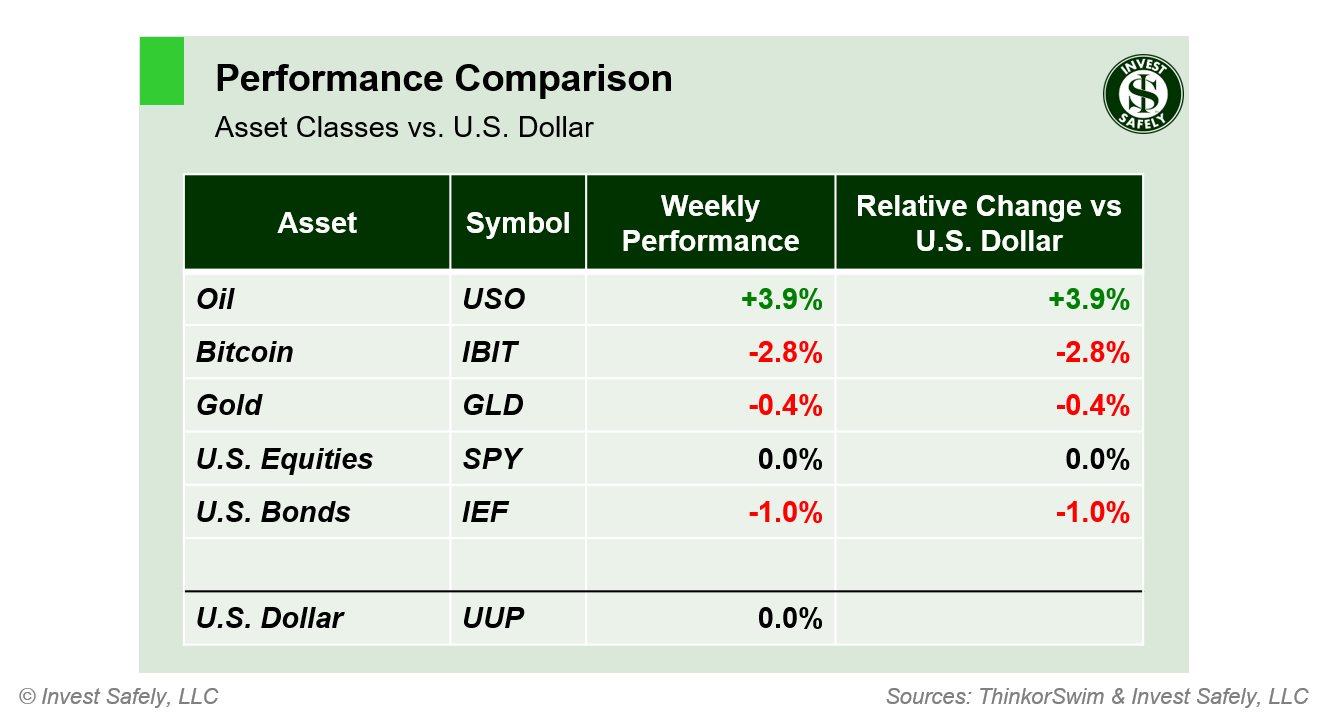

Bitcoin led to the downside again last week, but by a much smaller margin than last time. Oil led the way higher.

COMMENTARY

Last post, the Sahm rule and recession fears that were top of mind for financial media. Last week, it was the Yen-Carry trade crashing global markets, and the need for the U.S. Fed to provide emergency rate cuts.

The Bank of Japan announced a rate hike, which caught market participants off guard and sent the Nikkei index down more than 12% in one day. Japanese stocks recovered a majority of those losses in the following session.

Policy surprises of any kind tend to generate volatility, which is why the Fed has started putting the word out months ahead of any policy change (remember when the FOMC was thinking about “thinking about” rate hikes a few years ago?).

The resulting equity market volatility stoked fears that the long-awaited unwind of the Yen-carry trade was in progress. We discussed the Yen carry trade back in March when the first hike was announced.

In the States, some pundits initially attributed the U.S. sell-off to the lower than expected jobs data, released the prior Friday. The knee-jerk reaction was a call for emergency rate cuts to stave off the further weakening of the stock market…I mean the economy…I mean price stability and labor markets

It doesn’t matter that the same outlets were dismissing the idea of any economic or labor weakness when the GDP figures were released two weeks ago. Newsflash: the Fed isn’t supposed to prop up equity markets (whether they do from time to time, in coordination with the Treasury, is another discussion entirely).

As equity markets recovered, financial media softened their call for immediate rate cuts. The creator of the Sahm rule was trotted out on several networks to cool recession fears, stating that this time really is different because immigration, specifically unemployed immigrants, is skewing the number higher.

By the end of the week, the narrative had settled on knee-jerk reactions to the surprise jobs data and BOJ rate hike. Maybe they all realized that an emergency rate cut would create even more pressure to unwind the yen-carry trade, not to mention signaling a lack of confidence in the current market environment, both of which could provide another downside catalyst. Or maybe too much money was allocated to low volatility trading strategies and got caught offsides…

Regardless of the narrative, volatility returned in a BIG way last week, with the SPX volatility index ($VIX) reaching the mid-60’s on Monday. As a reminder, a reading above 30 is considered an extremely difficult time to hold equities due to big, fast price swings. It’s also when equities tend to underperform other asset classes.

Sure enough, recent asset class and sector price movement also align with a weaker environment for equities, with leadership in bonds/gold & REITs/Utilities indicating a deflationary environment in place (when measuring their relative performance over the past 4 weeks).

More volatility could be in the cards this week, with the release of the latest inflation data (PPI & CPI). The year over year comparisons aren’t particularly high, so we should see inflation flat or slowing, bolstering the calls for rate cuts in September.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.