Weekend Stock Market Outlook – July 21 2024

Stock Market Outlook entering the Week of July 21st = Uptrend

- ADX Directional Indicators: Mixed

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place for U.S. equities, despite the sell-off in big tech.

The S&P500 ($SPX) fell 2% last week. The index now sits ~2% above the 50-day moving average and ~11% above the 200-day moving average. Nevertheless, the index remains historically extended from the 200-day, so further downside can’t be ruled out. 5500 is an important accumulation level from late June, so keep an eye of price behavior next week to see if buyers step in.

The ADX shifts to mixed, reflecting the downward price action. Institutional activity was also negative, although not enough to change the signal. Thursday and Friday’s session aren’t considered distribution days due to declining trading volumes, but they still indicate higher than average selling pressure.

Digging into last week’s decline shows a wide range of performance. Tech was the worst sector ($XLK) by far, largely due to negative headlines concerning the semiconductor industry. Energy was the best sector ($XLE), which was a surprise given oil’s performance (see below), followed closely by real estate ($XLRE) and financials ($XLF).

Small caps continued their rally, leading all sector styles. Large cap and momentum styles underperformed, largely due to their weighting toward technology and semiconductor companies.

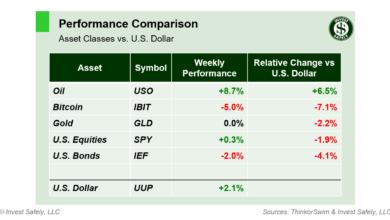

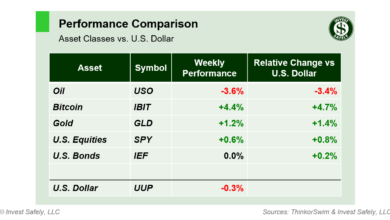

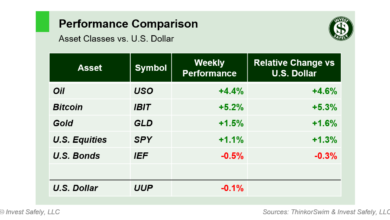

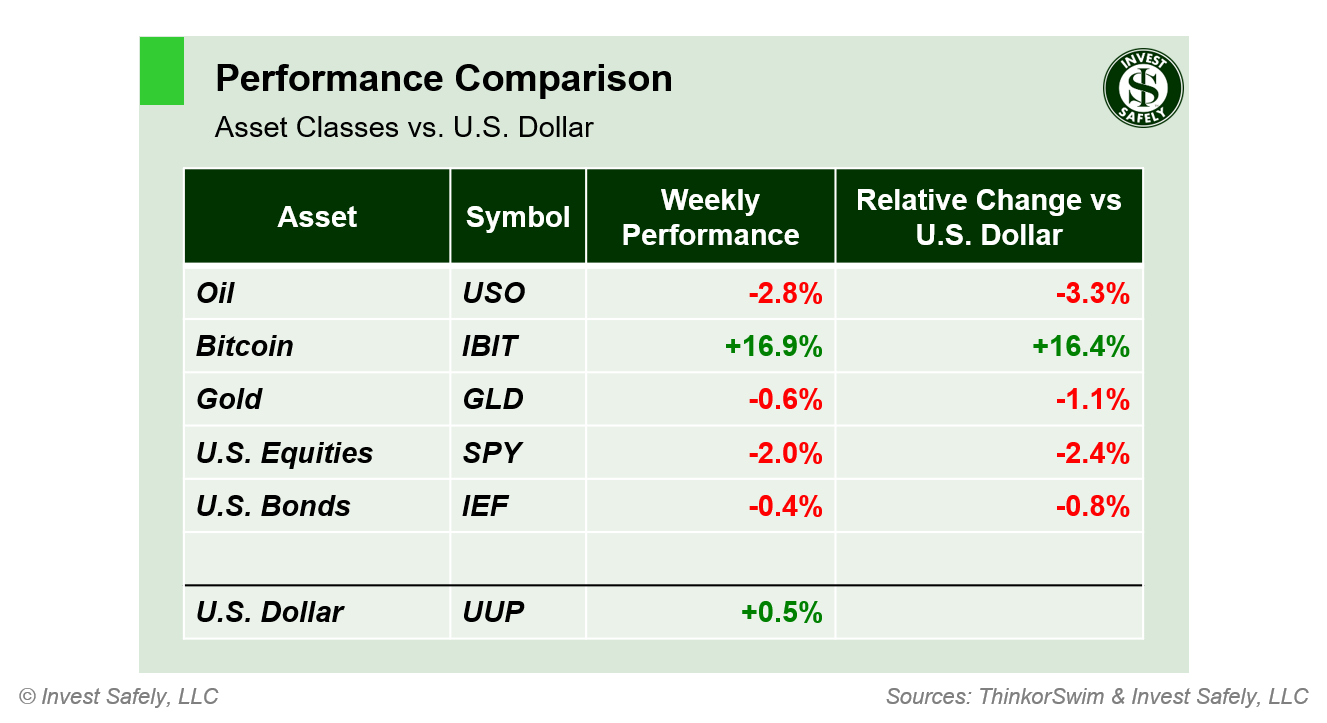

And from an asset class view, Bitcoin led the way again, climbing ~17% and reminding everyone why it’s still a risk asset and not a store of value yet. Oil was the worst asset class, dropping almost 3%.

COMMENTARY

Earnings season is in full swing, which 2 of the Mag 7 set to report this week: Tesla and Alphabet ($TSLA / $GOOGL).

No major economic news last week; June retail sales fell slightly in June (2.3% vs. 2.6% y/y), and weekly data showed a small increase in jobless claims. This week we’ll get Durable Goods orders and the first Q2 GDP estimate Thursday morning, followed by the all important June PCE data Friday morning.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.