Weekend Stock Market Outlook – September 1 2024

Stock Market Outlook entering the Week of September 1st = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place, with prices just below another all time high.

The S&P500 ($SPX) rose 0.2% last week. The index sits ~3% above the 50-day moving average and ~10% above the 200-day moving average.

All three signals show an uptrend in place. Index volume picked up at the end of the week, as a result of end of the month trading ahead of a long weekend. The ADX shows a weak trend in place, the young rally already has 3 distribution days to it’s credit. Neither of those two data points are highly supporting of a rally or a market making new all time highs.

The financial sector ($XLF) led the way by a relatively large margin, while technology stocks ($XLK) lagged thanks to Nvidia earnings (more below).

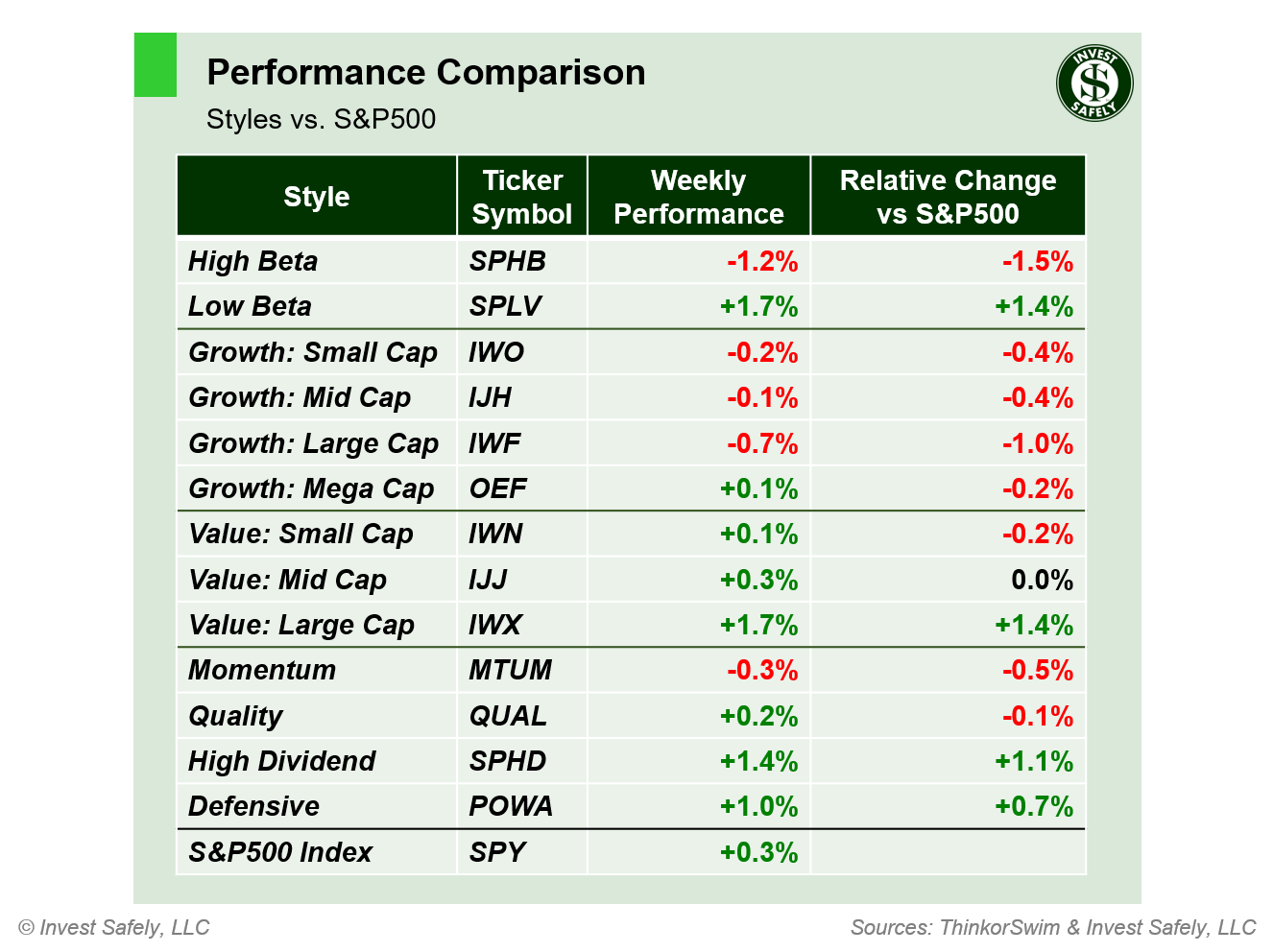

Low beta and Large Cap Value had the highest returns last week, while High Beta underperformed.

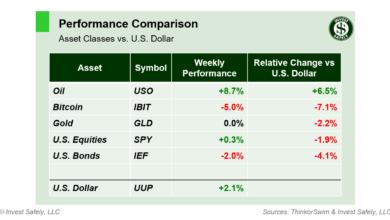

A strong performance by the U.S. dollar put pressure on all the other asset classes. Bitcoin let to the downside.

COMMENTARY

Nvidia reported another strong quarter for revenue and earnings. However, it was the smallest beat in recent memory, and shows that growth is starting to slow albiet from ridiculously high levels. The market typically views the first signs of a slowdown harshly, so the post-earnings sell-off wasn’t too surprising.

The headline number for durable goods was much higher than expected. Most of the outperformance came from transportation equipment. The second estimate of 2nd quarter GDP also came in higher than expected at 3%; greater than the Q1 reading of 1.4%, and last year’s Q2 level of 2.1%.

PCE showed no change in year over year inflation in July.

| PCE (y/y) | Actual | Prior |

Expected |

| Headline | +2.5% | +2.5% | +2.6% |

| Core | +2.6% | +2.6% | +2.7% |

U.S. equity markets are closed tomorrow for the Labor Day holiday. Upcoming data releases include ISM Manufacturing & Services PMI, JOLTs job openings, and August Non-farm Payrolls.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.