Weekend Stock Market Outlook – September 22 2024

Stock Market Outlook entering the Week of September 22nd = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook uptrend held strong through the volatility of the FOMC rate cut decision and a massive quarterly options expiration.

The S&P500 ($SPX) rallied 1.4% last week. The index sits ~3% above the 50-day moving average and ~10% above the 200-day moving average.

The Average Directional Index (ADX) and On-Balance Volume (OBV) remained bullish last week. Institutional activity switching to an uptrend on Thursdays move, but also added 2 distribution days to the count: outright on Tuesday and a stalling day (stealth selling) on Wednesday.

Energy ($XLE) outperformed the broader market last week, buoyed by rising oil prices. Real Estate ($XLRE) and Consumer Staples ($XLP) were the laggards.

Style-wise, High Beta ($SPHB) was the best sector for the second week in a row, while Low Beta ($SPLV) was the worst performer.

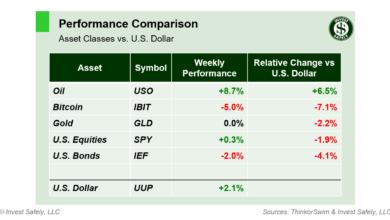

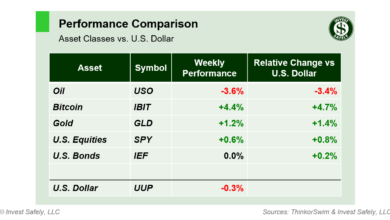

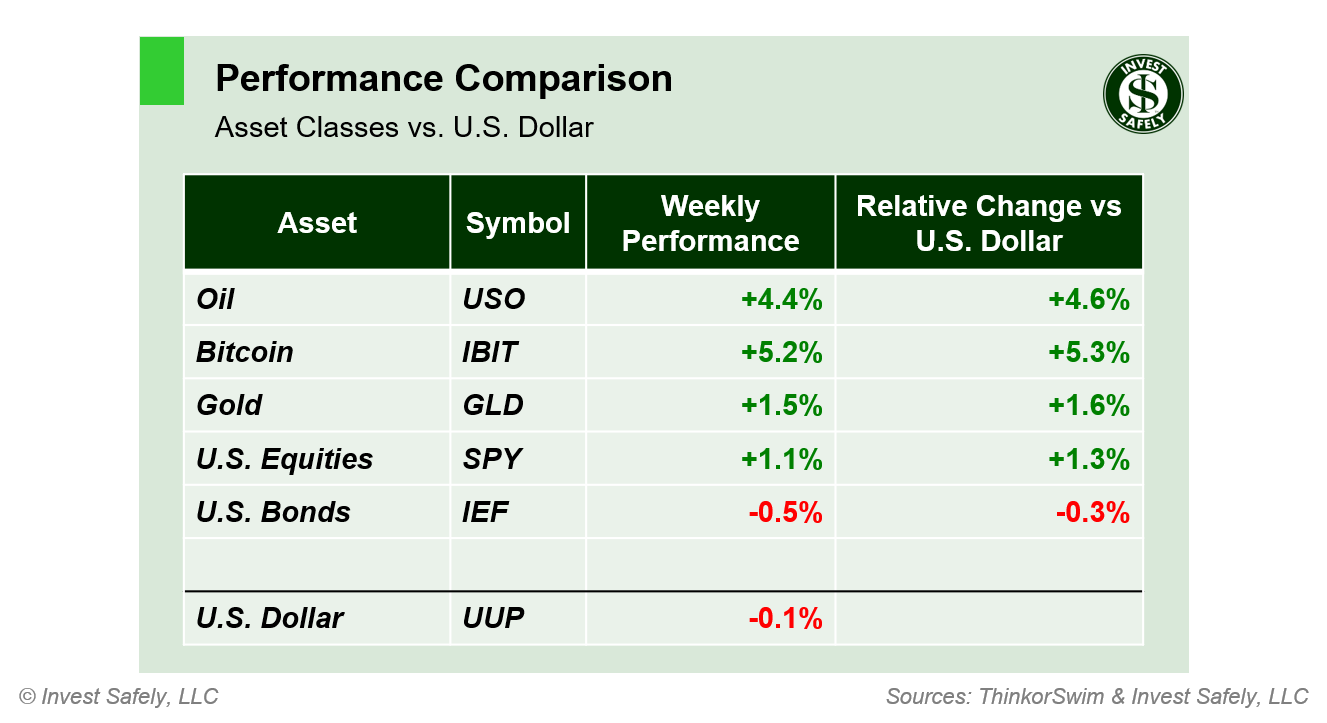

Since high volatility was the best investing style, it should be no surprise that Bitcoin led asset class returns for the second week in a row. Bonds underperformed, which is a bit surprising given the FOMC rate cut decision.

COMMENTARY

The FOMC started the rate cutting cycle last week, choosing to drop it’s policy rate by 0.5% on Wednesday, citing the need to accommodate a new economic environment. While a 25 basis point cut was as close to a certainty as one can get in investing, the 50 basis point cut caught some by surprise (including myself). However, Treasury rates across the yield curve actually rose after the FOMC announcement, indicating the market got a bit too aggressive by pricing in too many future rate cuts.

Upcoming macro events include the final Q2 GDP adjustment and speech from Federal Reserve Chairman Powell on Thursday, as well as August PCE data on Friday.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.